CPD Policy

Alpha Asset Management Pty Ltd AFSL No. 480258 ABN 30 163 817 114 (we, us, our)

Overview

Continuing Professional Development (CPD) encompasses the wide variety of learning activities undertaken by professionals on an ongoing basis to maintain their technical knowledge and skills and to continually develop such competencies in existing and emerging areas. We consider CPD and the quality of advice and services to be directly correlated. For this reason, CPD plays an important part in our advisers’ professional and personal development within our business. Our advisers means our authorised representatives who provide financial advice on our behalf.

We are required to have a CPD policy which sets out our processes for ensuring our financial advisers undertake CPD required to comply with the CPD legislative framework and ensure they are providing services to a competent and professional standard. This policy is published on our website and is also available internally to all staff.

What is the legislative framework?

CPD requirements are prescribed by the Corporations Act, the Corporations (Relevant Providers Continuing Professional Development Standard) Determination 2018 (Determination) and Financial Adviser Standards and Ethics Authority (FASEA). FASEA is the governing body that regulates training and education standards for advisers.

Advisers are required to undertake CPD every CPD year to improve their knowledge and competencies within broader CPD categories. A minimum number of hours have to be completed in each CPD category, but the CPD in total must meet the minimum hour requirements for each CPD year. Our CPD year is a financial year.

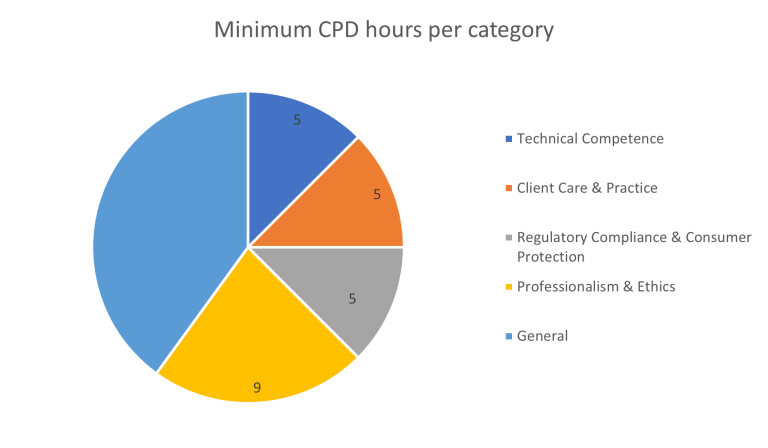

The CPD categories and respective minimum hours are summarised in the chart below:

Full-time advisers are required to complete at least 40 hours of ‘qualifying CPD’ each CPD year and ensure that they have met the minimum hour requirements in each CPD category. Part-time advisers can apply to us to reduce their total CPD load to 36 hours of qualifying CPD, although that is subject to our written approval which we will only provide if we are reasonably satisfied that the reduced load will not compromise the adviser’s skills and competence.

What comprises ‘qualifying CPD’ is set out in the Determination. Qualifying CPD must:

70% of the qualifying CPD undertaken by our advisers must be approved by us. Qualifying CPD will usually take the form of courses, presentations or other educational material that meets the criteria set out above. It may also constitute professional or technical reading (maximum of 4 hours) and formal education (maximum of 30 hours).

How we ensure compliance?

It is our responsibility to promote a culture of professional learning and development. Our role in ensuring advisers comply with their CPD obligations can be summarised in four separate components:

Training records

Advisers are required to obtain records of qualifying CPD they undertake and must promptly provide those to us so we can substantiate their attendance/completion of CPD. Completion of qualifying CPD will be recorded on the training register, which we maintain for this purpose. We will keep these records for a period of 7 years or as otherwise required by our document retention procedures.

Monitoring and review

We will continually monitor the effectiveness of the procedures set out in this policy. We may amend it from time to time by uploading the updated policy to our website.